FINANCIAL ANALYSIS

2nd semester

Write your answers in

the blank space below each question.

Question 1: In general accounting, explain

what we call “revenue accounts” and what we call “capital accounts”.

Revenue accounts are accounts

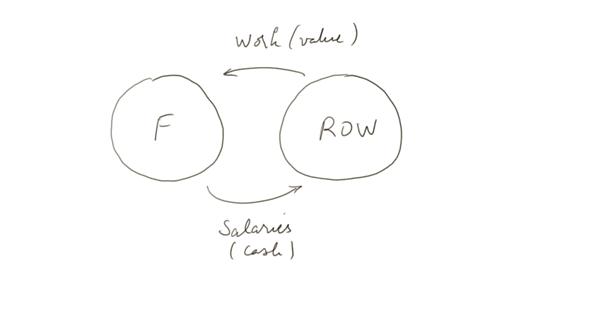

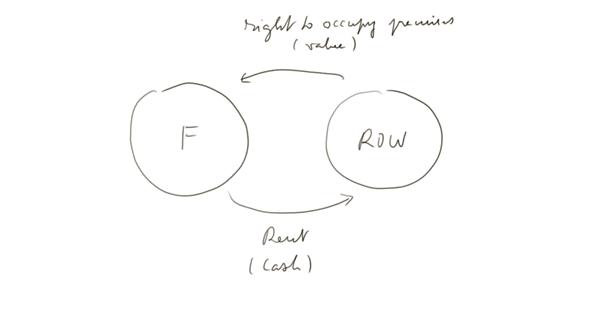

recording sales and consumptions during the accounting period under study. For instance :

-

work consumed (which correspond to salaries paid),

-

right to occupy premises (which correspond to rent paid),

-

raw materials,

-

current expenditures,

-

but also depreciation of the year,

-

provisions for bad clients, etc.

All the revenue accounts balances,

for a given period, form the Income Statement:

Sales – [ all

consumptions + adjustments ] = Net

profit or loss.

Capital accounts are all the other

accounts. Their balances end up in the Balance Sheet, plus the balance of the

Income Statement (that is the Net profit or loss).

Question 2: If the balance sheet of a firm has

a total of 120 million euros (= total assets, and = total liabilities), and the “free

debt” is 35 million euros, and the Net Fixed Assets are 50 million euros, what

is the amount of the Working Capital? (Don’t just give a figure, explain your

answer.)

Working capital = Capital employed –

Net fixed assets.

Capital employed = Equity + Costly

debt = Total liabilities – Free debt

So CE = 85 mio

euros.

And WC = 85 - 50 = 35 mio euros.

Question 3: Explain what is the Working

Capital, and why it bears this name.

The Working capital is the part of

the Capital employed which finances something else than the Net fixed assets.

(It can be negative.)

It is called Working capital,

because – if we assimilate “capital” to only the “capital employed” that is

capital which needs to be remunerated one way or another – it is the part of

the “capital” that is not for fixed assets, but is “working” (stocks, possibly

a part of the clients).

Question 4: At the end of its first year of

operation, the Trial balance of a firm (before adjustments) is this

At the end of the year, we

make the following adjustments:

- yearly depreciation of the van: 600 euros

- opening stocks = 0; closing stocks = 2000

euros

What are the two accounts we have to create to

post the yearly depreciation of 600 euros?

We create an account “Yearly depreciation

IS”, debited 600 euros, and an account “Yearly depreciation BS”, credited 600 euros.

This second account will be renamed

“Cumulated depreciation”, and will stay, in the balance sheet, filled with

figures from one year to the next.

What are the two accounts we have to create to

post the measurement (after inventory) of the closing stocks of 2000 euros?

We create an account “Closing stocks

IS”, credited 2000 euros, and an account “Closing

stocks BS”, debited 2000 euros.

We also may want to create an

account “Opening stocks IS”, which receives no entry since this is the first

year of operations.

Next year, the “Closing stocks BS”

will become the “Opening stocks IS”.

Question 5: (question 4 cont’d) Fill in the

balance sheet

|

balance sheet |

||||||

|

assets |

|

liabilities |

||||

|

accounts |

debit |

credit |

|

accounts |

debit |

credit |

|

Machinery |

0 |

|

|

Capital |

|

10 000 |

|

Van |

3 000 |

|

|

Cum ret. earnings |

|

900 |

|

Cum dep |

|

600 |

|

Long term loans |

|

0 |

|

Stocks |

2

000 |

|

|

Creditors |

|

6

500 |

|

Clients |

1

000 |

|

|

|

|

|

|

Bank & Cash |

12

000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

total |

18 000 |

600 |

|

total |

|

17 400 |

To plug in the “Cumulated retained

earnings” figure requires to have solved question 6.

Question 6: (question 4 cont’d) Fill in the

income statement

|

Income statement |

|||

|

accounts |

|

debit |

credit |

|

Sales |

|

|

9 000 |

|

Opening stocks |

|

0 |

|

|

Purchases |

|

7 000 |

|

|

Closing stocks IS |

|

|

2 000 |

|

|

|

|

|

|

|

|

|

|

|

gross margin |

|

|

4 000 |

|

Salaries |

|

0 |

|

|

Rent |

|

1 000 |

|

|

Shop expenses |

|

1 500 |

|

|

Yearly depreciation |

|

600 |

|

|

|

|

|

|

|

profit or loss |

|

|

900 |

Question 7: (this exercise is no longer the

continuation of question 4) At the end of last year, a

firm has a result before interest and taxes of 90 million euros. And its

balance sheet (in million of euros) is this:

What is the ROCE?

ROCE = Result before interest and taxes

/ Capital employed

= 90 / 580 = 15,5%

(Since, we have only the ending

balance sheet, we cannot average the capital employed at the beginning of the

year, and the capital employed at the end of the year. So, we use only the CE

at the end of the year.)

Question 8: (question 7 cont’d) What is the current ratio?

Current ratio = Current assets / Current liabilities = 520 / 160 =

3,25

Is this ratio a good figure? What can you say

about the management of its free debt by the firm?

Generally speaking, this figure is

too high. A good figure is around 1. The management does not use enough of its

possibilities of “free debt”, which means that it uses “costly debt” to finance

a part of its assets, when it is not necessary.

Of course, when a firm begins, it

doesn’t have access to much free debt. So our comment is very general, and

doesn’t apply all the time.

Question 9: Is it possible that a firm see its

cash position increase between the beginning and the end of an exercise, and

yet the firm make a loss in its income statement? Explain.

Yes.

The variation of cash in the till is

not directly related to the profit or loss. The profit or loss, during the

accounting period, is only the change in Equity, provided there was no raising of new capital.

It is possible to make a loss, and

yet have its cash position increase. It is sufficient for that to sell some

assets.

Question 10: A firm F sells for 100 euros on

credit to G some product that was recorded in F’s stocks with the value 40

euros. Explain the “income statement” for just this transaction, and the impact

on F’s balance sheet.

Income statement:

Sales = 100

Opening stocks – Closing stocks = 40

Purchases = 0

Other costs = none

Net profit = 60

Balance sheet:

Asset side:

Stocks decrease by 40

Clients increase by 100

Liability side:

Cumulated retained earnings increase

by 60

Question 11: (from now on, questions in

elementary finance) What is a financial product?

A financial product is a contract

between two agents specifying movements of cash, between them, now and in

the future, sometimes depending upon various conditions.

The movement now can be nil. But

there must be movements agreed upon in the future.

The simplest example is agent A giving 1000 euros now to agent B, and B promising to give to

A 50 euros every year for five years, and on the fifth year B also pays back to

A 1000 euros.

Such a contract held by A to receive

cash flows from B, can be resold later to agent C for a price which will depend

on economic conditions at the time of the resale. In effect, A sells to C a

stream of future cash flows. It can also be traded by B,

it is usually called a swap: B will actually pay C to take charge of its payment

responsibilities.

There are more complicated financial

products. But they always encompass future cash flows (or possibilities of future cash flows) for one or both agents. Both

agents can exchange their part of the contract for something else.

Another simple example is an

insurance policy. Say A is the insurance company, and B is the policy holder.

At the initial time, A pays nothing to B. B begins to

pay a yearly premium to A. Should a damage occur to B, A will pay B a sum

specified in the contract. Such a contract can be traded by A to C, as well as

by B to C.

Question 12: An investor buys a bond issued by

a firm. What are the two other names of the investor?

Lender (of money)

Buyer (of a security)

And what are the two other names of the issuer?

Borrower (of money)

Seller (of a security)

Question 13: A firm is considering making an

investment, which will have the following cash flows:

C0 = 80 million euros (this is the

money to be invested at the beginning)

and the three next cash flows will be money

produced by the investment:

C1 = 30 million euros

C2 = 50 million euros

C3 = 50 million euros

What are the two fundamental discount rates

attached to any investment?

The opportunity cost of capital. It

is the yield of a security in the same class of risk as the investment.

The internal rate of

return.

It is a generalisation of the concept of profitability.

The Op. Cost of Cap. is

an external piece of information, which is not obtainable from the figures

above. We need more information about the investment and its environment to find

it out.

The IRR is an internal piece of information

(we also say “endogeneous”), which can be calculated

from the figures above.

Question 14: (question 13 cont’d) Suppose we discount the cash flows with a discount rate of

10%. What is the NPV of the investment?

|

discount rate |

|

10,00% |

|

|

|

|

|

|

|

|

|

years |

0 |

1 |

2 |

3 |

|

|

|

|

|

|

|

cf |

-80,00 |

30,00 |

50,00 |

50,00 |

|

|

|

|

|

|

|

pv |

-80,00 |

27,27 |

41,32 |

37,57 |

|

|

|

|

|

|

|

npv |

26,16 |

|

|

|

Question 15: (question 13 cont’d) Suppose we discount now with a discount rate of 20%. What is

the NPV, in that second case, of the investment?

|

discount rate |

|

20,00% |

|

|

|

|

|

|

|

|

|

years |

0 |

1 |

2 |

3 |

|

|

|

|

|

|

|

cf |

-80,00 |

30,00 |

50,00 |

50,00 |

|

|

|

|

|

|

|

pv |

-80,00 |

25,00 |

34,72 |

28,94 |

|

|

|

|

|

|

|

npv |

8,66 |

|

|

|

Question 16: (question 13 cont’d) Estimate the

IRR of the investment. (Use geometry or any other method, but explain your

estimation.)

By trial and error, we find IRR

equals approximately 26,3%

Question 17: Two friends of yours have, each of them, an investment project and offer you to

participate. Friend A offers you to invest 5000 euros in his project, and tells

you you will receive 3000 euros after one year, and 3000 euros after two years. Friend B, with his own

project, different from A’s, offers you the same cash flows: you invest 5000

and get 3000 et 3000.

Are the two projects necessarily equivalent for

you from a financial point of view?

No.

Explain what other parameter must be taken into

account to evaluate the projects.

It also depends on the risk of each

project.

I’d rather lend 1000 euros at 10% to

a reliable friend, than lend 1000 euros at 20% to a foolhardy one.

Question 18: You are offered to invest 7000

euros today, and get either

a) 10000 euros in two years, or

b) 5000 in one year and 5000 in three years.

Everything else being equal, which option do

you prefer? Explain

Calculations show that b) is better

than a).

This can be readily seen from the

fact that what b) adds to a) (5000 earlier) is higher than what b) loses from

a) (5000 later).

Question 19: Why was BKC, who wanted to bail

out and take the control of Heuliez and had promised

to bring 15 million euros of cash, eventually forced to give up? What did they

bring instead of cash and why wasn’t it sufficient?

BKC was not able to bring the cash

they had promised. Instead they offered client paper. But client paper is less

liquid, and less sure, than cash. And if they weren’t able to transform their

client paper into almost 15 mio euros, this proves

that it wasn’t very good client paper.

Question 20: The public debt of

The teacher doesn’t believe that

this debt will ever significantly decrease, either in absolute value or in

percentage of the French GDP, in the future.

Rather, other financial and monetary

phenomena will take place.

Which ones?

They will happen over the next 30

years, and be momentous:

-

rise of new private moneys (in new currencies, administered by large

global firms),

-

loss of relevance of governments of nation-states (that were built over

the last thousand years!), relinquishing of the present debt (which will become

akin to “Russian bonds”),

-

profound evolution of our societies toward new social categories and

relations,

-

and also some sort of new form of

feudality.

What will be the likely consequences during

your lifetime?

Be aware that your future will be strikingly

different from what you know today.